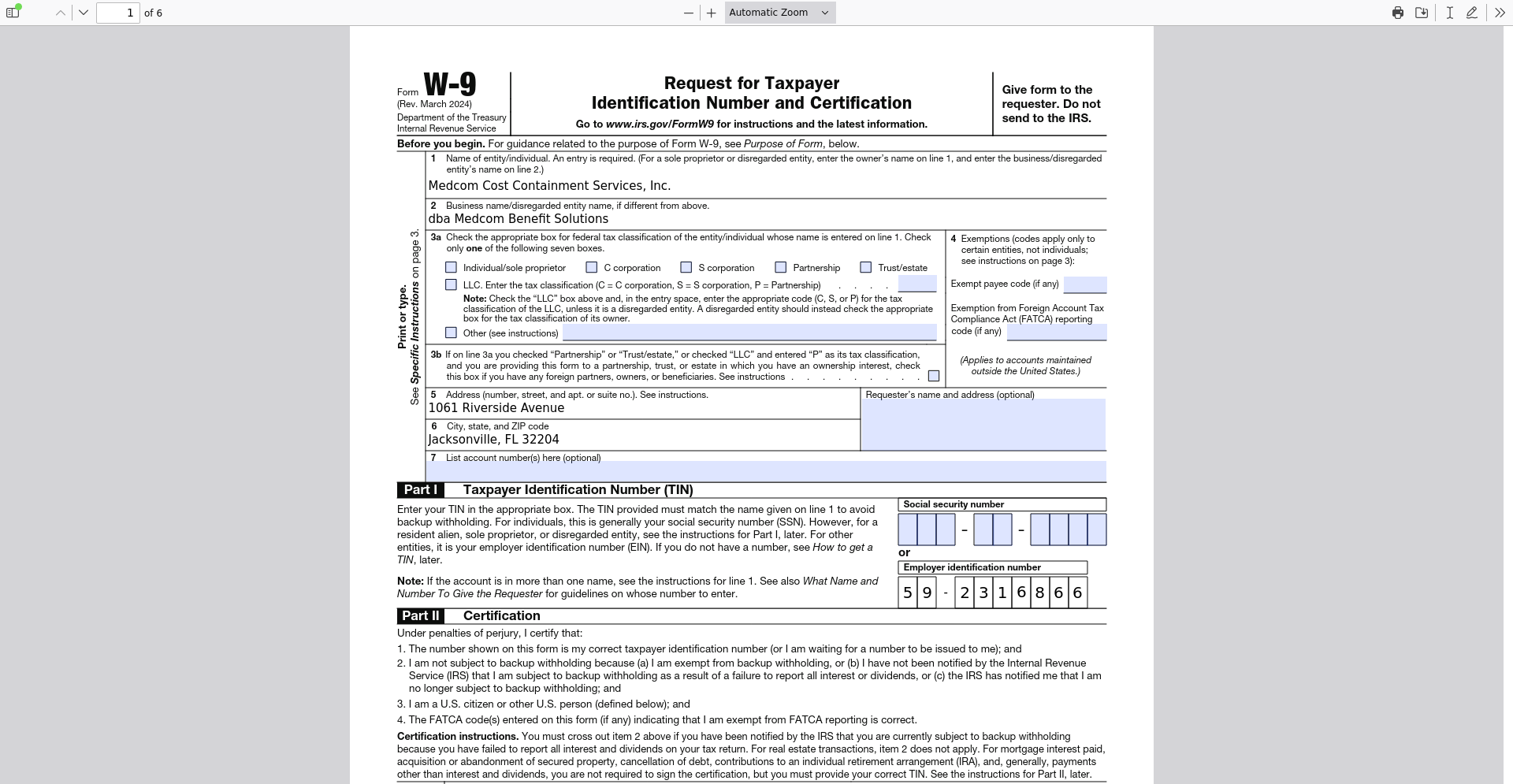

https://medcombenefits.com/images/uploads/documents/MedcomW9.pdf

Last Checked: Apr 16, 2024, 12:32 EDT

| IP Address: | 75.119.194.139 |

| ASN #: | AS26347 DREAMHOST-AS, US |

| Location: | Unknown, Unknown, Unknown |

| URL Reputation: |

|

Domain Name: medcombenefits.com

Registry Domain ID: 2256630082_DOMAIN_COM-VRSN

Registrar WHOIS Server: whois.godaddy.com

Registrar URL: https://www.godaddy.com

Updated Date: 2023-04-25T11:56:24Z

Creation Date: 2018-04-25T08:00:00Z

Registrar Registration Expiration Date: 2025-04-25T08:00:00Z

Registrar: GoDaddy.com, LLC

Registrar IANA ID: 146

Registrar Abuse Contact Email: abuse@godaddy.com

Registrar Abuse Contact Phone: +1.4806242505

Domain Status: clientTransferProhibited https://icann.org/epp#clientTransferProhibited

Domain Status: clientUpdateProhibited https://icann.org/epp#clientUpdateProhibited

Domain Status: clientRenewProhibited https://icann.org/epp#clientRenewProhibited

Domain Status: clientDeleteProhibited https://icann.org/epp#clientDeleteProhibited

Registry Registrant ID: Not Available From Registry

Registrant Name: Registration Private

Registrant Organization: Domains By Proxy, LLC

Registrant Street: DomainsByProxy.com

Registrant Street: 2155 E Warner Rd

Registrant City: Tempe

Registrant State/Province: Arizona

Registrant Postal Code: 85284

Registrant Country: US

Registrant Phone: +1.4806242599

Registrant Phone Ext:

Registrant Fax:

Registrant Fax Ext:

Registrant Email: Select Contact Domain Holder link at https://www.godaddy.com/whois/results.aspx?domain=medcombenefits.com

Registry Admin ID: Not Available From Registry

Admin Name: Registration Private

Admin Organization: Domains By Proxy, LLC

Admin Street: DomainsByProxy.com

Admin Street: 2155 E Warner Rd

Admin City: Tempe

Admin State/Province: Arizona

Admin Postal Code: 85284

Admin Country: US

Admin Phone: +1.4806242599

Admin Phone Ext:

Admin Fax:

Admin Fax Ext:

Admin Email: Select Contact Domain Holder link at https://www.godaddy.com/whois/results.aspx?domain=medcombenefits.com

Registry Tech ID: Not Available From Registry

Tech Name: Registration Private

Tech Organization: Domains By Proxy, LLC

Tech Street: DomainsByProxy.com

Tech Street: 2155 E Warner Rd

Tech City: Tempe

Tech State/Province: Arizona

Tech Postal Code: 85284

Tech Country: US

Tech Phone: +1.4806242599

Tech Phone Ext:

Tech Fax:

Tech Fax Ext:

Tech Email: Select Contact Domain Holder link at https://www.godaddy.com/whois/results.aspx?domain=medcombenefits.com

Name Server: RUBEN.NS.CLOUDFLARE.COM

Name Server: ZITA.NS.CLOUDFLARE.COM

DNSSEC: unsigned

URL of the ICANN WHOIS Data Problem Reporting System: http://wdprs.internic.net/

>>> Last update of WHOIS database: 2024-04-16T16:32:49Z <<<

For more information on Whois status codes, please visit https://icann.org/epp

TERMS OF USE: The data contained in this registrar's Whois database, while believed by the

registrar to be reliable, is provided "as is" with no guarantee or warranties regarding its

accuracy. This information is provided for the sole purpose of assisting you in obtaining

information about domain name registration records. Any use of this data for any other purpose

is expressly forbidden without the prior written permission of this registrar. By submitting

an inquiry, you agree to these terms and limitations of warranty. In particular, you agree not

to use this data to allow, enable, or otherwise support the dissemination or collection of this

data, in part or in its entirety, for any purpose, such as transmission by e-mail, telephone,

postal mail, facsimile or other means of mass unsolicited, commercial advertising or solicitations

of any kind, including spam. You further agree not to use this data to enable high volume, automated

or robotic electronic processes designed to collect or compile this data for any purpose, including

mining this data for your own personal or commercial purposes. Failure to comply with these terms

may result in termination of access to the Whois database. These terms may be subject to modification

at any time without notice.

-

GET200 OK

https://firefox.settings.services.mozilla.com/v1/buckets/main/collections/partitioning-exempt-urls/changeset?_expected=1702403047185

<html dir="ltr" mozdisallowselectionprint="" style="--viewer-container-height: 963px;"><head>

<meta charset="utf-8">

<meta name="viewport" content="width=device-width, initial-scale=1, maximum-scale=1">

<title>Form W-9 (Rev. March 2024) - MedcomW9.pdf</title>

<!-- This snippet is used in the Firefox extension (included from viewer.html) -->

<script src="resource://pdf.js/build/pdf.js"></script>

<link rel="stylesheet" href="resource://pdf.js/web/viewer.css">

<script src="resource://pdf.js/web/viewer.js"></script>

</head>

<body tabindex="1">

<div id="outerContainer">

<div id="sidebarContainer">

<div id="toolbarSidebar">

<div id="toolbarSidebarLeft">

<div id="sidebarViewButtons" class="splitToolbarButton toggled" role="radiogroup">

<button id="viewThumbnail" class="toolbarButton toggled" title="Show Thumbnails" tabindex="2" data-l10n-id="thumbs" role="radio" aria-checked="true" aria-controls="thumbnailView">

<span data-l10n-id="thumbs_label">Thumbnails</span>

</button>

<button id="viewOutline" class="toolbarButton" title="Show Document Outline (double-click to expand/collapse all items)" tabindex="3" data-l10n-id="document_outline" role="radio" aria-checked="false" aria-controls="outlineView">

<span data-l10n-id="document_outline_label">Document Outline</span>

</button>

<button id="viewAttachments" class="toolbarButton" title="Show Attachments" tabindex="4" data-l10n-id="attachments" role="radio" aria-checked="false" aria-controls="attachmentsView" disabled="">

<span data-l10n-id="attachments_label">Attachments</span>

</button>

<button id="viewLayers" class="toolbarButton" title="Show Layers (double-click to reset all layers to the default state)" tabindex="5" data-l10n-id="layers" role="radio" aria-checked="false" aria-controls="layersView" disabled="">

<span data-l10n-id="layers_label">Layers</span>

</button>

</div>

</div>

<div id="toolbarSidebarRight">

<div id="outlineOptionsContainer" class="hidden">

<div class="verticalToolbarSeparator"></div>

<button id="currentOutlineItem" class="toolbarButton" title="Find Current Outline Item" tabindex="6" data-l10n-id="current_outline_item">

<span data-l10n-id="current_outline_item_label">Current Outline Item</span>

</button>

</div>

</div>

</div>

<div id="sidebarContent">

<div id="thumbnailView"><a href="#page=1" title="Page 1"><div class="thumbnail selected" data-page-number="1"><div class="thumbnailSelectionRing" style="width: 100px; height: 128px;"></div></div></a><a href="#page=2" title="Page 2"><div class="thumbnail" data-page-number="2"><div class="thumbnailSelectionRing" style="width: 100px; height: 128px;"></div></div></a><a href="#page=3" title="Page 3"><div class="thumbnail" data-page-number="3"><div class="thumbnailSelectionRing" style="width: 100px; height: 128px;"></div></div></a><a href="#page=4" title="Page 4"><div class="thumbnail" data-page-number="4"><div class="thumbnailSelectionRing" style="width: 100px; height: 128px;"></div></div></a><a href="#page=5" title="Page 5"><div class="thumbnail" data-page-number="5"><div class="thumbnailSelectionRing" style="width: 100px; height: 128px;"></div></div></a><a href="#page=6" title="Page 6"><div class="thumbnail" data-page-number="6"><div class="thumbnailSelectionRing" style="width: 100px; height: 128px;"></div></div></a></div>

<div id="outlineView" class="hidden"><div class="treeItem"><a href="#%5B%7B%22num%22%3A38%2C%22gen%22%3A0%7D%2C%7B%22name%22%3A%22FitH%22%7D%2C796%5D">fw9updated2024-04-12_1.pdf</a></div><div class="treeItem"><a href="#%5B%7B%22num%22%3A39%2C%22gen%22%3A0%7D%2C%7B%22name%22%3A%22FitH%22%7D%2C796%5D">fw9updated2024-04-12_2.pdf</a></div><div class="treeItem"><a href="#%5B%7B%22num%22%3A40%2C%22gen%22%3A0%7D%2C%7B%22name%22%3A%22FitH%22%7D%2C796%5D">fw9updated2024-04-12_3.pdf</a></div><div class="treeItem"><a href="#%5B%7B%22num%22%3A41%2C%22gen%22%3A0%7D%2C%7B%22name%22%3A%22FitH%22%7D%2C796%5D">fw9updated2024-04-12_4.pdf</a></div><div class="treeItem"><a href="#%5B%7B%22num%22%3A42%2C%22gen%22%3A0%7D%2C%7B%22name%22%3A%22FitH%22%7D%2C796%5D">fw9updated2024-04-12_5.pdf</a></div><div class="treeItem"><a href="#%5B%7B%22num%22%3A44%2C%22gen%22%3A0%7D%2C%7B%22name%22%3A%22FitH%22%7D%2C796%5D">fw9updated2024-04-12_6.pdf</a></div></div>

<div id="attachmentsView" class="hidden"></div>

<div id="layersView" class="hidden"></div>

</div>

<div id="sidebarResizer"></div>

</div> <!-- sidebarContainer -->

<div id="mainContainer">

<div class="findbar hidden doorHanger" id="findbar">

<div id="findbarInputContainer">

<input id="findInput" class="toolbarField" title="Find" placeholder="Find in document…" tabindex="91" data-l10n-id="find_input" aria-invalid="false">

<div class="splitToolbarButton">

<button id="findPrevious" class="toolbarButton" title="Find the previous occurrence of the phrase" tabindex="92" data-l10n-id="find_previous">

<span data-l10n-id="find_previous_label">Previous</span>

</button>

<div class="splitToolbarButtonSeparator"></div>

<button id="findNext" class="toolbarButton" title="Find the next occurrence of the phrase" tabindex="93" data-l10n-id="find_next">

<span data-l10n-id="find_next_label">Next</span>

</button>

</div>

</div>

<div id="findbarOptionsOneContainer">

<input type="checkbox" id="findHighlightAll" class="toolbarField" tabindex="94">

<label for="findHighlightAll" class="toolbarLabel" data-l10n-id="find_highlight">Highlight All</label>

<input type="checkbox" id="findMatchCase" class="toolbarField" tabindex="95">

<label for="findMatchCase" class="toolbarLabel" data-l10n-id="find_match_case_label">Match Case</label>

</div>

<div id="findbarOptionsTwoContainer">

<input type="checkbox" id="findMatchDiacritics" class="toolbarField" tabindex="96">

<label for="findMatchDiacritics" class="toolbarLabel" data-l10n-id="find_match_diacritics_label">Match Diacritics</label>

<input type="checkbox" id="findEntireWord" class="toolbarField" tabindex="97">

<label for="findEntireWord" class="toolbarLabel" data-l10n-id="find_entire_word_label">Whole Words</label>

</div>

<div id="findbarMessageContainer" aria-live="polite">

<span id="findResultsCount" class="toolbarLabel"></span>

<span id="findMsg" class="toolbarLabel"></span>

</div>

</div> <!-- findbar -->

<div class="editorParamsToolbar hidden doorHangerRight" id="editorFreeTextParamsToolbar">

<div class="editorParamsToolbarContainer">

<div class="editorParamsSetter">

<label for="editorFreeTextColor" class="editorParamsLabel" data-l10n-id="editor_free_text_color">Color</label>

<input type="color" id="editorFreeTextColor" class="editorParamsColor" tabindex="100">

</div>

<div class="editorParamsSetter">

<label for="editorFreeTextFontSize" class="editorParamsLabel" data-l10n-id="editor_free_text_size">Size</label>

<input type="range" id="editorFreeTextFontSize" class="editorParamsSlider" value="10" min="5" max="100" step="1" tabindex="101">

</div>

</div>

</div>

<div class="editorParamsToolbar hidden doorHangerRight" id="editorInkParamsToolbar">

<div class="editorParamsToolbarContainer">

<div class="editorParamsSetter">

<label for="editorInkColor" class="editorParamsLabel" data-l10n-id="editor_ink_color">Color</label>

<input type="color" id="editorInkColor" class="editorParamsColor" tabindex="102">

</div>

<div class="editorParamsSetter">

<label for="editorInkThickness" class="editorParamsLabel" data-l10n-id="editor_ink_thickness">Thickness</label>

<input type="range" id="editorInkThickness" class="editorParamsSlider" value="1" min="1" max="20" step="1" tabindex="103">

</div>

<div class="editorParamsSetter">

<label for="editorInkOpacity" class="editorParamsLabel" data-l10n-id="editor_ink_opacity">Opacity</label>

<input type="range" id="editorInkOpacity" class="editorParamsSlider" value="100" min="1" max="100" step="1" tabindex="104">

</div>

</div>

</div>

<div id="secondaryToolbar" class="secondaryToolbar hidden doorHangerRight">

<div id="secondaryToolbarButtonContainer">

<button id="secondaryPrint" class="secondaryToolbarButton visibleMediumView" title="Print" tabindex="52" data-l10n-id="print">

<span data-l10n-id="print_label">Print</span>

</button>

<button id="secondaryDownload" class="secondaryToolbarButton visibleMediumView" title="Save" tabindex="53" data-l10n-id="save">

<span data-l10n-id="save_label">Save</span>

</button>

<div class="horizontalToolbarSeparator visibleMediumView"></div>

<button id="presentationMode" class="secondaryToolbarButton" title="Switch to Presentation Mode" tabindex="54" data-l10n-id="presentation_mode">

<span data-l10n-id="presentation_mode_label">Presentation Mode</span>

</button>

<a href="#page=1&zoom=auto,-266,792" id="viewBookmark" class="secondaryToolbarButton" title="Current Page (View URL from Current Page)" tabindex="55" data-l10n-id="bookmark1">

<span data-l10n-id="bookmark1_label">Current Page</span>

</a>

<div id="viewBookmarkSeparator" class="horizontalToolbarSeparator"></div>

<button id="firstPage" class="secondaryToolbarButton" title="Go to First Page" tabindex="56" data-l10n-id="first_page" disabled="">

<span data-l10n-id="first_page_label">Go to First Page</span>

</button>

<button id="lastPage" class="secondaryToolbarButton" title="Go to Last Page" tabindex="57" data-l10n-id="last_page">

<span data-l10n-id="last_page_label">Go to Last Page</span>

</button>

<div class="horizontalToolbarSeparator"></div>

<button id="pageRotateCw" class="secondaryToolbarButton" title="Rotate Clockwise" tabindex="58" data-l10n-id="page_rotate_cw">

<span data-l10n-id="page_rotate_cw_label">Rotate Clockwise</span>

</button>

<button id="pageRotateCcw" class="secondaryToolbarButton" title="Rotate Counterclockwise" tabindex="59" data-l10n-id="page_rotate_ccw">

<span data-l10n-id="page_rotate_ccw_label">Rotate Counterclockwise</span>

</button>

<div class="horizontalToolbarSeparator"></div>

<div id="cursorToolButtons" role="radiogroup">

<button id="cursorSelectTool" class="secondaryToolbarButton toggled" title="Enable Text Selection Tool" tabindex="60" data-l10n-id="cursor_text_select_tool" role="radio" aria-checked="true">

<span data-l10n-id="cursor_text_select_tool_label">Text Selection Tool</span>

</button>

<button id="cursorHandTool" class="secondaryToolbarButton" title="Enable Hand Tool" tabindex="61" data-l10n-id="cursor_hand_tool" role="radio" aria-checked="false">

<span data-l10n-id="cursor_hand_tool_label">Hand Tool</span>

</button>

</div>

<div class="horizontalToolbarSeparator"></div>

<div id="scrollModeButtons" role="radiogroup">

<button id="scrollPage" class="secondaryToolbarButton" title="Use Page Scrolling" tabindex="62" data-l10n-id="scroll_page" role="radio" aria-checked="false">

<span data-l10n-id="scroll_page_label">Page Scrolling</span>

</button>

<button id="scrollVertical" class="secondaryToolbarButton toggled" title="Use Vertical Scrolling" tabindex="63" data-l10n-id="scroll_vertical" role="radio" aria-checked="true">

<span data-l10n-id="scroll_vertical_label">Vertical Scrolling</span>

</button>

<button id="scrollHorizontal" class="secondaryToolbarButton" title="Use Horizontal Scrolling" tabindex="64" data-l10n-id="scroll_horizontal" role="radio" aria-checked="false">

<span data-l10n-id="scroll_horizontal_label">Horizontal Scrolling</span>

</button>

<button id="scrollWrapped" class="secondaryToolbarButton" title="Use Wrapped Scrolling" tabindex="65" data-l10n-id="scroll_wrapped" role="radio" aria-checked="false">

<span data-l10n-id="scroll_wrapped_label">Wrapped Scrolling</span>

</button>

</div>

<div class="horizontalToolbarSeparator"></div>

<div id="spreadModeButtons" role="radiogroup">

<button id="spreadNone" class="secondaryToolbarButton toggled" title="Do not join page spreads" tabindex="66" data-l10n-id="spread_none" role="radio" aria-checked="true">

<span data-l10n-id="spread_none_label">No Spreads</span>

</button>

<button id="spreadOdd" class="secondaryToolbarButton" title="Join page spreads starting with odd-numbered pages" tabindex="67" data-l10n-id="spread_odd" role="radio" aria-checked="false">

<span data-l10n-id="spread_odd_label">Odd Spreads</span>

</button>

<button id="spreadEven" class="secondaryToolbarButton" title="Join page spreads starting with even-numbered pages" tabindex="68" data-l10n-id="spread_even" role="radio" aria-checked="false">

<span data-l10n-id="spread_even_label">Even Spreads</span>

</button>

</div>

<div class="horizontalToolbarSeparator"></div>

<button id="documentProperties" class="secondaryToolbarButton" title="Document Properties…" tabindex="69" data-l10n-id="document_properties" aria-controls="documentPropertiesDialog">

<span data-l10n-id="document_properties_label">Document Properties…</span>

</button>

</div>

</div> <!-- secondaryToolbar -->

<div class="toolbar">

<div id="toolbarContainer">

<div id="toolbarViewer">

<div id="toolbarViewerLeft">

<button id="sidebarToggle" class="toolbarButton pdfSidebarNotification" title="Toggle Sidebar (document contains outline/attachments/layers)" tabindex="11" data-l10n-id="toggle_sidebar_notification2" aria-expanded="false" aria-controls="sidebarContainer">

<span data-l10n-id="toggle_sidebar_label">Toggle Sidebar</span>

</button>

<div class="toolbarButtonSpacer"></div>

<button id="viewFind" class="toolbarButton hidden" title="Find in Document" tabindex="12" data-l10n-id="findbar" aria-expanded="false" aria-controls="findbar">

<span data-l10n-id="findbar_label">Find</span>

</button>

<div class="splitToolbarButton hiddenSmallView">

<button class="toolbarButton" title="Previous Page" id="previous" tabindex="13" data-l10n-id="previous" disabled="">

<span data-l10n-id="previous_label">Previous</span>

</button>

<div class="splitToolbarButtonSeparator"></div>

<button class="toolbarButton" title="Next Page" id="next" tabindex="14" data-l10n-id="next">

<span data-l10n-id="next_label">Next</span>

</button>

</div>

<input type="number" id="pageNumber" class="toolbarField" title="Page" value="1" min="1" tabindex="15" data-l10n-id="page" autocomplete="off" max="6">

<span id="numPages" class="toolbarLabel">of 6</span>

</div>

<div id="toolbarViewerRight">

<button id="print" class="toolbarButton hiddenMediumView" title="Print" tabindex="32" data-l10n-id="print">

<span data-l10n-id="print_label">Print</span>

</button>

<button id="download" class="toolbarButton hiddenMediumView" title="Save" tabindex="33" data-l10n-id="save">

<span data-l10n-id="save_label">Save</span>

</button>

<div class="verticalToolbarSeparator hiddenMediumView"></div>

<div id="editorModeButtons" class="splitToolbarButton toggled" role="radiogroup">

<button id="editorFreeText" class="toolbarButton" title="Text" role="radio" aria-checked="false" tabindex="34" data-l10n-id="editor_free_text2">

<span data-l10n-id="editor_free_text2_label">Text</span>

</button>

<button id="editorInk" class="toolbarButton" title="Draw" role="radio" aria-checked="false" tabindex="35" data-l10n-id="editor_ink2">

<span data-l10n-id="editor_ink2_label">Draw</span>

</button>

</div>

<div id="editorModeSeparator" class="verticalToolbarSeparator"></div>

<button id="secondaryToolbarToggle" class="toolbarButton" title="Tools" tabindex="48" data-l10n-id="tools" aria-expanded="false" aria-controls="secondaryToolbar">

<span data-l10n-id="tools_label">Tools</span>

</button>

</div>

<div id="toolbarViewerMiddle">

<div class="splitToolbarButton">

<button id="zoomOut" class="toolbarButton" title="Zoom Out" tabindex="21" data-l10n-id="zoom_out">

<span data-l10n-id="zoom_out_label">Zoom Out</span>

</button>

<div class="splitToolbarButtonSeparator"></div>

<button id="zoomIn" class="toolbarButton" title="Zoom In" tabindex="22" data-l10n-id="zoom_in">

<span data-l10n-id="zoom_in_label">Zoom In</span>

</button>

</div>

<span id="scaleSelectContainer" class="dropdownToolbarButton" style="--scale-select-width: 141.9499969482422px;">

<select id="scaleSelect" title="Zoom" tabindex="23" data-l10n-id="zoom">

<option id="pageAutoOption" title="" value="auto" selected="selected" data-l10n-id="page_scale_auto">Automatic Zoom</option>

<option id="pageActualOption" title="" value="page-actual" data-l10n-id="page_scale_actual">Actual Size</option>

<option id="pageFitOption" title="" value="page-fit" data-l10n-id="page_scale_fit">Page Fit</option>

<option id="pageWidthOption" title="" value="page-width" data-l10n-id="page_scale_width">Page Width</option>

<option id="customScaleOption" title="" value="custom" disabled="disabled" hidden="true"></option>

<option title="" value="0.5" data-l10n-id="page_scale_percent" data-l10n-args="{ "scale": 50 }">50%</option>

<option title="" value="0.75" data-l10n-id="page_scale_percent" data-l10n-args="{ "scale": 75 }">75%</option>

<option title="" value="1" data-l10n-id="page_scale_percent" data-l10n-args="{ "scale": 100 }">100%</option>

<option title="" value="1.25" data-l10n-id="page_scale_percent" data-l10n-args="{ "scale": 125 }">125%</option>

<option title="" value="1.5" data-l10n-id="page_scale_percent" data-l10n-args="{ "scale": 150 }">150%</option>

<option title="" value="2" data-l10n-id="page_scale_percent" data-l10n-args="{ "scale": 200 }">200%</option>

<option title="" value="3" data-l10n-id="page_scale_percent" data-l10n-args="{ "scale": 300 }">300%</option>

<option title="" value="4" data-l10n-id="page_scale_percent" data-l10n-args="{ "scale": 400 }">400%</option>

</select>

</span>

</div>

</div>

<div id="loadingBar" style="--progressBar-percent: 100%; --progressBar-end-offset: 12px;" class="hidden">

<div class="progress">

<div class="glimmer">

</div>

</div>

</div>

</div>

</div>

<div id="viewerContainer" tabindex="0">